how to get agi

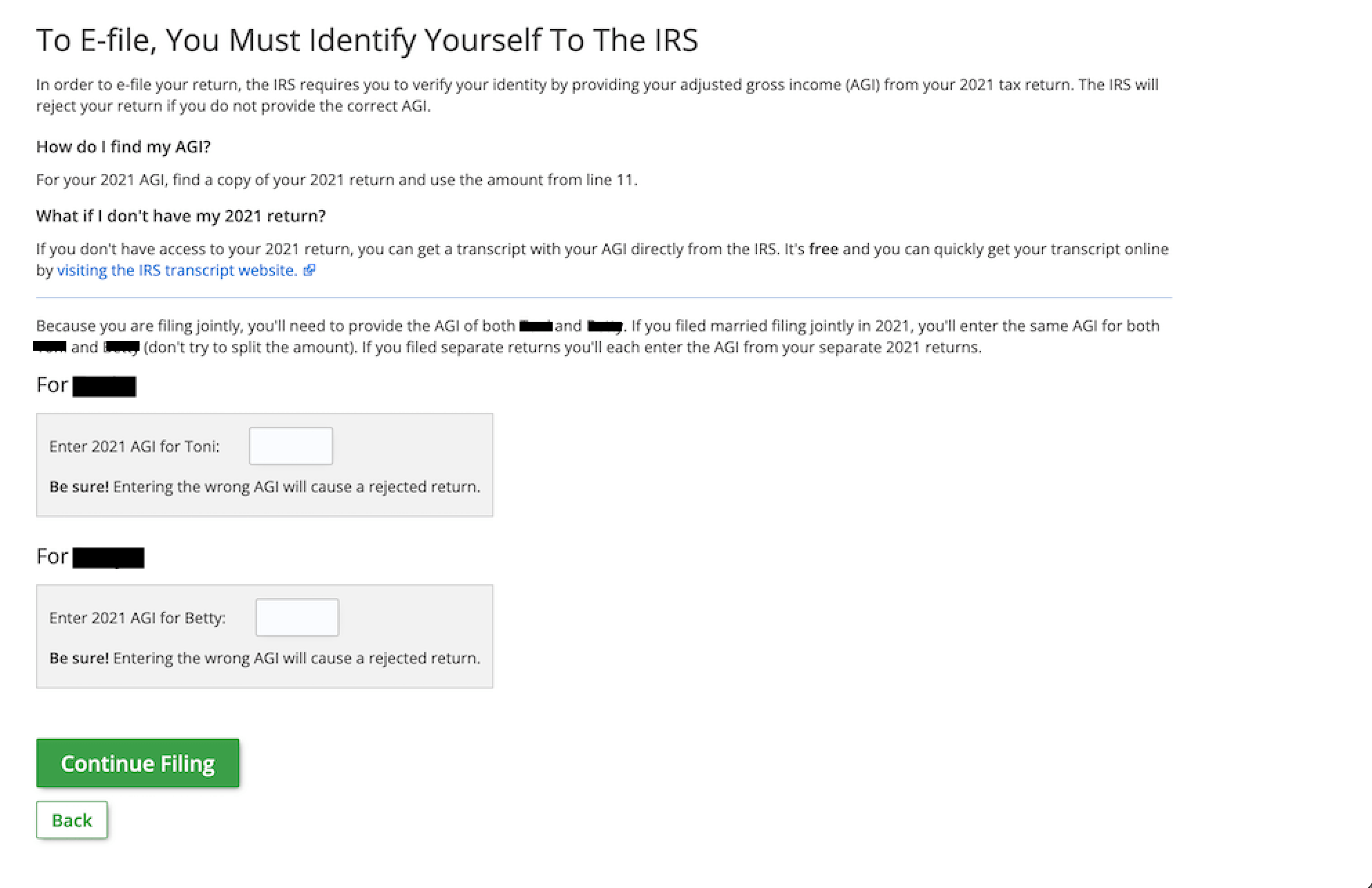

Here are the steps to estimate your AGI using your paystub. Call the IRS at 800-908-9946 and request a hard copy transcript be mailed to you.

What Was Your Parents Adjusted Gross Income For 2019 Federal Student Aid

This will take 5-10 business days.

. If you already hold an FAA Flight Instructor certificate CFI ASE or AME and you want to get an AGI now all you need to do is follow these 3 steps. If your 2019 tax return has not yet been processed enter 0 zero dollars for your prior year adjusted gross income AGI. Start with your gross income.

File your taxes at your own pace. Your income will include. First you will have to gather your income and tax statements.

Taxpayers can use Get Transcript by Mail or call 800-908-9946 to order a tax. 1 Click File on the left gray menu box. For example eligibility for some lucrative tax deductions and credits is determined by AGI as is.

To find your AGI. To get a transcript taxpayers can. Basically there are 3 steps to this.

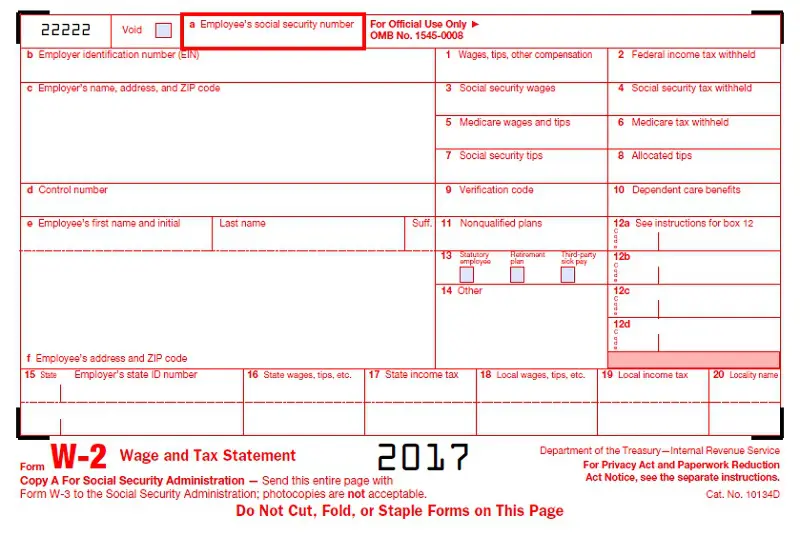

There are other ways you can get your Prior years AGI. Steps To Calculate Your AGI Adjusted Gross Income Using W-2 Form. The IRS Website The IRS keeps a record of your previous years tax returns.

File your taxes stress-free online with TaxAct. Enter Payment Info Here. How to calculate adjusted gross income Adjusted gross income is your gross income minus your adjustments.

Finding Your AGI. With TurboTax Its Fast And Easy To Get Your Taxes Done Right. Dont let your taxes become a hassle.

3 Your return will be. If you do not know your AGI you can request a transcript from the IRS for the prior year AGI amount. You wont find your AGI on your W-2 or 1099 form because those forms dont take into account over a dozen above-the-line deductions that go into calculating your AGI.

When you file a tax return you will always see a line to figure out your adjusted gross income or AGI before arriving at your taxable income number. Ad Filing your taxes just became easier. They can use the Get Transcript tool on IRSgov.

The simple steps involved in calculating your AGI from the information given on W-2 are. Ad Connect With A Tax Expert For Guidance Importing Last Years Returns Finish Your Taxes. If you used the Non-Filers.

If you and your spouse filed jointly last year your spouses. So if you cannot find your tax return from. Adjusted gross income or AGI can be useful to know for several reasons.

How to calculate adjusted gross income AGI Use this adjusted gross income formula to determine your AGI. If this is your first return that you have filed or if you did not file a return in the previous. On your final paystub locate the total YTD earnings amount usually listed under Earnings Total YTD.

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. Taking Gross Income from the W-2 form. Line 11 on Form 1040 and 1040-SR on tax year 2020 form Line 8b on Form 1040 and 1040-SR on tax year 2019 form Line 7 on Form 1040 on tax year 2018.

You can locate your federal gross wages on your W-2 form. Income is on lines 7-22 of Form 1040 Add. 2 You will see your refundbalance due amount.

Ad Connect With A Tax Expert For Guidance Importing Last Years Returns Finish Your Taxes.

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

Where Can I Find My Agi If I Filed With Jackson Hewitt Last Year

Modified Adjusted Gross Income Magi

What Is Adjusted Gross Income Agi Gusto

Student Loans And Adjusted Gross Income Agi Tips For Low Payments

2020 Adjusted Gross Income Or Agi For The 2021 Tax Return

0 Response to "how to get agi"

Post a Comment